Mastering Personal Finance for Students: A Comprehensive Guide

In today’s world, managing personal finance for students is a crucial life skill that everyone should possess, especially for students. Effective personal finance for students requires a deep understanding of student loan management, budgeting strategies, and part-time job guidance.

If you’re a student struggling to manage your finances, don’t worry – you’re not alone. In this comprehensive guide, we’ll walk you through the essential strategies to master personal finance for students and set yourself up for long-term financial success.

Student Loan Management Strategies for Financial Freedom

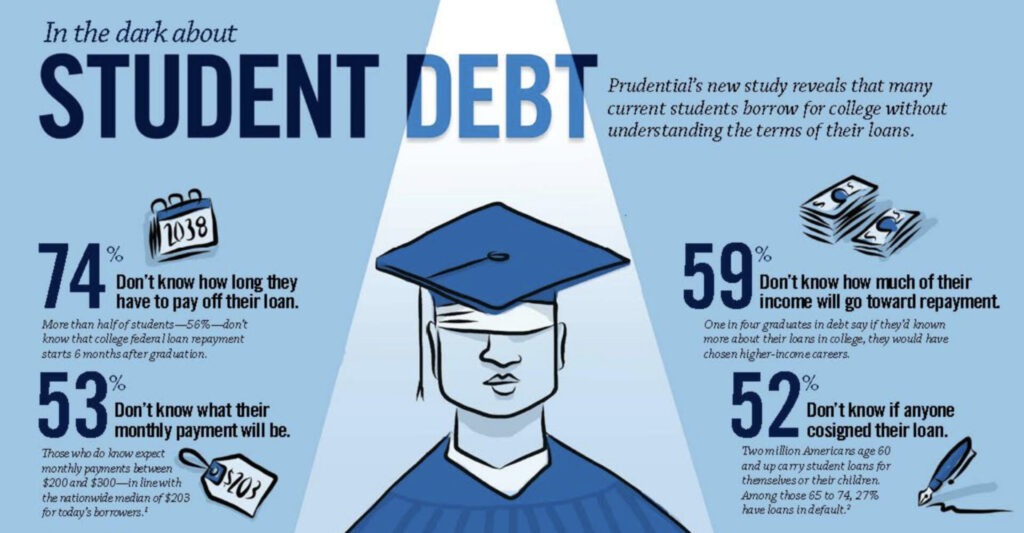

Understanding the different federal repayment plans and income-driven options is crucial for personal finance management as a student. When it comes to student loans, it’s essential to know your options and choose the right plan to suit your needs. Here are some key strategies to help you manage your student loans effectively:

- Debt Avalanche Method:

This method involves paying off your loans with the highest interest rates first. By doing so, you can save money on interest and pay off your loans faster.

- Paying More Than the Minimum:

Paying more than the minimum payment on your loans can help you pay off the principal amount faster and reduce the overall interest paid.

- Biweekly Payments:

Making biweekly payments can help you pay off your loans faster by making 26 payments per year instead of 12.

By implementing these strategies, you can significantly reduce interest and repayment time, making it easier to manage your student loans.

Budgeting, Expense Tracking & Personal FInance for Students

Creating a personal finance plan for students involves tracking expenses, prioritizing needs, and balancing academics with finances. Here are some essential tips to help you create an effective budget plan:

- 50/30/20 Rule:

Allocate 50% of your income towards necessary expenses like rent, utilities, and food. Use 30% for discretionary spending like entertainment and hobbies. And, put 20% towards saving and debt repayment.

- Easy-to-Follow Budget Plans:

Use a budgeting app or spreadsheet to track your expenses and stay on top of your finances.

- Prioritizing Needs:

Prioritize your needs over wants to ensure that you’re spending your money wisely.

By following these tips, you can create a budget plan that works for you and helps you manage your finances effectively.

Managing Part-Time Jobs and Employer Benefits

Finding and managing part-time jobs that complement studies without burnout is essential for student personal finance. Here are some key strategies to help you navigate part-time jobs and employer benefits:

- Flexibility: Look for part-time jobs that offer flexibility in terms of scheduling and work hours to ensure that you can balance your academics and finances.

- Employer Benefits: Explore employer student loan repayment programs and tax advantages to get the most out of your part-time job.

- Time Management: Prioritize your time and manage your schedule effectively to avoid burnout and maintain a healthy work-life balance.

By following these tips, you can find a part-time job that complements your studies and helps you manage your finances effectively.

Loan Forgiveness Programs and Refinancing Considerations

Understanding public service loan forgiveness and the risks of refinancing federal loans into private ones is vital for personal finance for college students. Here are some key considerations to keep in mind:

- Public Service Loan Forgiveness: Explore public service loan forgiveness programs that can help you forgive your loans after a certain period of time.

- Refinancing Risks: Understand the risks of refinancing federal loans into private ones and consider the pros and cons before making a decision.

- Staying Updated: Stay updated on legal and regulatory changes that can impact your student loans and make informed decisions.

By understanding these considerations, you can make informed decisions about your student loans and manage your finances effectively.

Building Emergency Funds and Savings

Emphasising the importance of building small emergency savings even on limited budgets, is crucial for student finance management. Here are some essential tips to help you build emergency funds and savings:

- Small Steps: Start small by saving a fixed amount each month, even if it’s just $10 or $20.

- Budgeting Tips: Use budgeting tips like the 50/30/20 rule to allocate your income towards necessary expenses, discretionary spending, and saving.

- Savings Strategies: Explore savings strategies like automatic transfers and compound interest to grow your savings over time.

By following these tips, you can build emergency funds and savings that will help you achieve financial stability and security.

Additional Resources for Personal Finance for Students

For more information on personal finance management for students, visit our website at monetify.in and explore our expert guides, calculators, and budget planners. We also offer a free newsletter that provides valuable tips and strategies on personal finance for students. Subscribe to our newsletter today and start achieving financial freedom.

People Also Ask: Personal Finance for Students – FAQs

1. What are the best student loan repayment plans for managing personal finances?

Students can use the debt avalanche method to repay high-interest loans first, make slightly higher monthly payments, or choose biweekly payments. These methods reduce interest costs and help clear loans faster without stressing monthly budgets.

2. How can students create an effective budget plan for college life?

Students should prioritise needs over wants, follow the simple 50/30/20 rule and track every expense. Using budgeting apps or a notebook helps them understand spending patterns and avoid unnecessary costs during college.

3. What are the benefits of employer student loan repayment programs?

These programs help reduce loan burden faster, offer tax advantages and sometimes provide flexible work hours. They allow students or young employees to manage debt better while focusing on building their early careers.

4. How can students start saving money with limited income?

Students can save small amounts from allowances, part-time jobs or scholarships. Cutting non-essential spending, using student discounts and following a strict monthly budget helps them build savings even with limited money.

5. Is investing possible for students with low income?

Yes, students can start investing with as little as ₹100 through SIPs or index funds. Starting early allows compounding to work in their favour, even if the initial amount is small.

To stay up-to-date on the latest personal finance tips and strategies, subscribe to our newsletter at https://monetify.in/newsletter and start achieving financial freedom today.

External Resources:

- National Foundation for Credit Counseling (NFCC): A non-profit organization that provides financial education and counseling services.

- Federal Student Aid: A government website that provides information on student loans and financial aid.

- The Balance: A personal finance website that provides tips and strategies on managing finances.

- NerdWallet: A personal finance website that provides information on student loans, credit cards, and other financial products.