Is Separating Business and Personal Finances for Freelancers worth it?

Separating business and personal finances isn’t just for big firms. It’s a practical step that brings real clarity to money decisions, taxes, and risk. When accounts mix, you can’t see what belongs to the business or what’s yours alone. You’ll learn what separation means, the common pitfalls, and simple strategies and tools to start today.

What does separating business and personal finances mean?

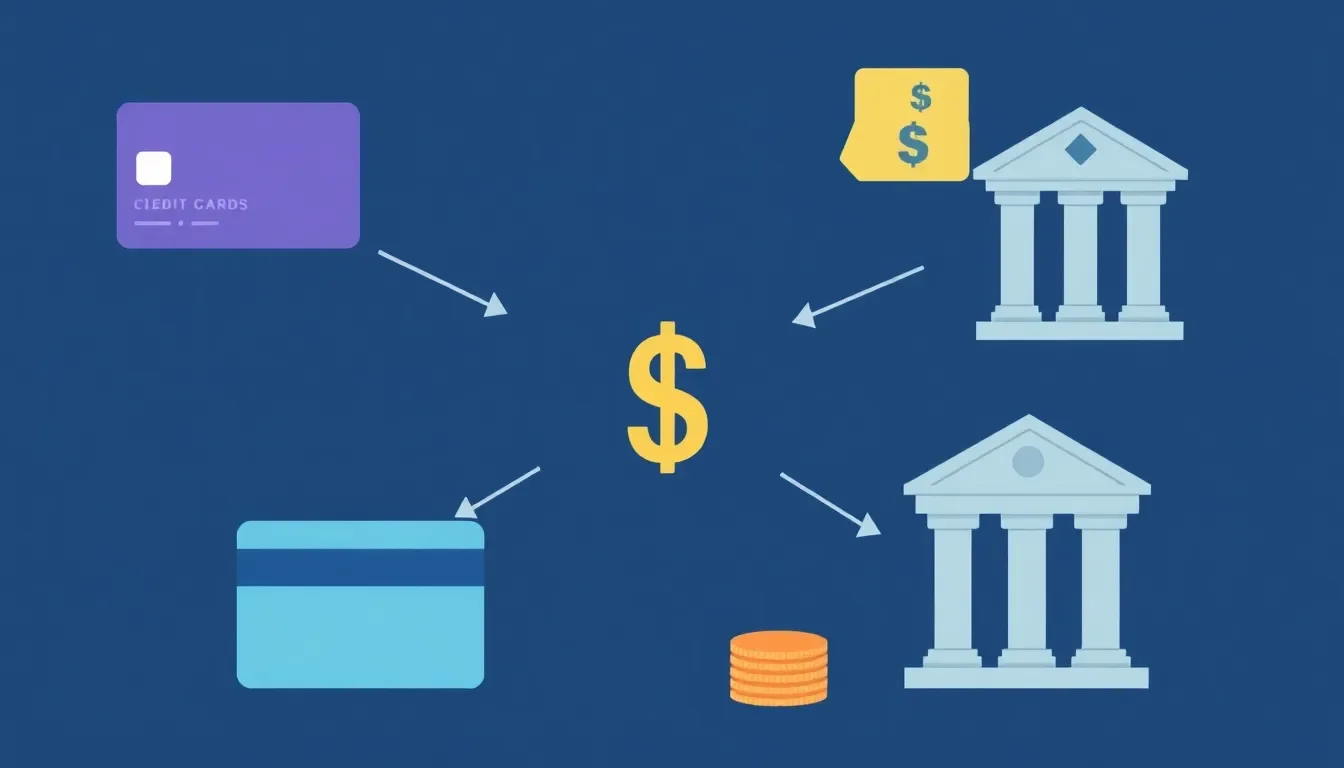

Separating means keeping business money apart from personal money. It starts with a dedicated business bank account, a business credit card, and paying yourself a regular salary from the business. When income, expenses, and debts live in separate spaces, it’s easier to see how the business runs and what belongs to you personally.

This clarity matters for taxes, liabilities, and planning. Tax time becomes less chaotic because business income and deductions stay in one place. Liability risk drops when personal assets aren’t tied to business debts or lawsuits. For freelancers and owners who mix money, a small misstep can lead to surprise tax bills or personal exposure.

Pain points show up fast. Tax complexities, keeping track of write offs, and handling reimbursements can be tricky without clear lines. Some freelancers worry about auditors or accidental personal liability if the business owes money. Others struggle to track cash flow when personal spending and business cash share the same accounts.

The solution is straightforward. Set up clear accounts, define a salary, and use simple tools to monitor cash flow. Expect to learn practical steps to create separation, how to choose the right accounts, and common mistakes to avoid. This post lays out concrete steps you can take now and points to trusted tools that automate parts of the process. As you read, you’ll see how separation sets the stage for smarter financial decisions and long term wealth planning.

Effective methods for financial separation

Separating business and personal finances starts with three concrete moves: open a business bank account, get a business credit card, and pay yourself like an employee. Each step makes tracking easier, lowers audit risk, and builds a paper trail lenders love.

Open dedicated bank accounts for business

A separate business account turns income and expenses into clear data. Deposits from clients land in one place, so you can see monthly revenue without guessing. Business bills pull from the same pot, so profit shows up as the leftover balance. This simple split saves hours at tax time—no more hunting through grocery receipts to find a client lunch.

Real example: Maya, a freelance designer, mixed money for two years. When she opened a business checking account, she discovered 18% of her “salary” was actually covering software subscriptions. After rerouting those costs, her real take-home pay rose $320 a month.

Choose an account with no monthly fee and free ACH transfers. Online-only banks often fit the bill. Pair the account with budgeting software to tag each transaction automatically. For software options, see Monetify’s guide to the best personal finance software.

External help:

Use business credit cards

A business card keeps spending in one lane and builds credit under the company’s name. At tax time, one statement shows every deductible purchase—no more lost receipts. Many cards export data straight into bookkeeping apps, turning a weekend of data entry into a five-minute upload.

Card issuers report to business credit bureaus, so on-time payments raise your business score. A higher score can unlock larger credit lines or lower-rate loans later. Pick a card with no annual fee the first year and cash-back on common expenses like advertising or shipping.

Tip: Set a daily limit slightly above your usual spend. If the card is compromised, losses stay capped.

Establish a payroll system

Paying yourself a steady salary turns variable gig income into predictable personal cash flow. Decide on a percentage of average monthly profit—say 60%. Transfer that amount from the business account to your personal checking on the same date each month. The leftover 40% stays inside the business for taxes, future gear, or slow months.

This habit keeps lifestyle creep in check. When a big client pays, you’re not tempted to upgrade your phone the same week. Instead, surplus sits in the business, ready for quarterly tax estimates or retirement contributions.

Example: Luis drives for a rideshare app and averages $4,800 profit a month. He sets an owner draw of $2,900 every fifteenth. The first year, his business savings covered two weeks off for vacation without touching personal funds.

Set calendar reminders to review the salary figure each quarter. If profit grows 15% or more for two straight months, raise the draw by half the gain. This keeps your personal budget rising with the business, not ahead of it.

Separating business and personal finances isn’t fancy—it’s just a series of small, repeatable habits. Open the right accounts, run spending through business plastic, and pay yourself on schedule. Do those three things and taxes get simpler, risk drops, and your future self will thank you.

Why does separating business and personal finances matter for freelancers?

For freelancers, separating business and personal finances isn’t just about tidy records—it’s a practical safeguard. It clarifies where money comes from and where it goes, and it helps you see your business health at a glance. This separation also shields personal assets and makes tax time less chaotic. The habit of separating business and personal finances sets a strong foundation for growth.

When you maintain clear boundaries, you improve cash flow planning, credit decisions, and reporting to clients or lenders. It’s easier to spot wasteful spending, track deductible expenses, and prepare accurate profit tests. For freelancers, separating business and personal finances isn’t just a tactic—it’s a long-term habit that supports sustainable earnings. If you want easy-to-follow guidance, check out trusted resources on how to handle business deductions and filings (for example, IRS guidance and reputable explainers from Investopedia and NerdWallet).

Take small, repeatable steps. Open a dedicated business bank account, use a business credit card for all business purchases, and pay yourself a regular salary from the business. These habits trim tax surprises, reduce personal liability, and give you clearer insight into where the business stands. For deeper reading, see external resources like the SBA’s guidance on managing finances and NerdWallet’s articles on keeping business and personal funds separate.

If you’d like a practical starting point, the next-step guide or checklist available through the internal resource can help you implement these practices now: https://monetify.in/personal-finance/personal-finance-tips/. For broader context, you can also explore external guidance from reputable sources such as https://www.irs.gov/businesses/small-businesses-self-employed/business-deductions, https://www.investopedia.com/terms/s/separating-finances.asp, and https://www.nerdwallet.com/article/small-business/free-business-checking.

End note: treating separation as a normal part of your workflow makes taxes, cash flow, and growth feel manageable rather than overwhelming.

FAQ for separating business and personal finances

What is separating business and personal finances?

In simple terms, it means keeping money for your business separate from your personal money. It usually involves a dedicated business bank account, a business credit card, and paying yourself a salary from the business. The goal is a clean line between income and expenses, so you can see how the business is really performing and protect personal assets if something goes wrong.

How can freelancers manage financial separation?

Start with three setup moves: open a business bank account, get a business credit card, and establish a regular payroll or owner-salary method. Track all business income and expenses in a dedicated system or software, and avoid using personal accounts for business cash flow. Use clear bookkeeping practices and review monthly to catch misclassified costs. If you want a practical toolkit, the internal resources and software guides can help you choose the right tools for you.

What tax implications arise from financial separation?

Separating finances simplifies tax reporting. You can more easily claim legitimate business deductions and separate personal expenses from business costs, reducing audit risk and improving accuracy on returns. It also clarifies how much you should pay in quarterly estimates and annual taxes. freelancers who separate finances often find it easier to manage home-office deductions, travel expenses, and startup costs, while keeping personal spending distinct. For deeper tax guidance, consult IRS materials and reputable tax resources.

A final thought: when you treat separating business and personal finances as a standard practice, you gain confidence to plan for growth rather than scramble during tax season or slow months.